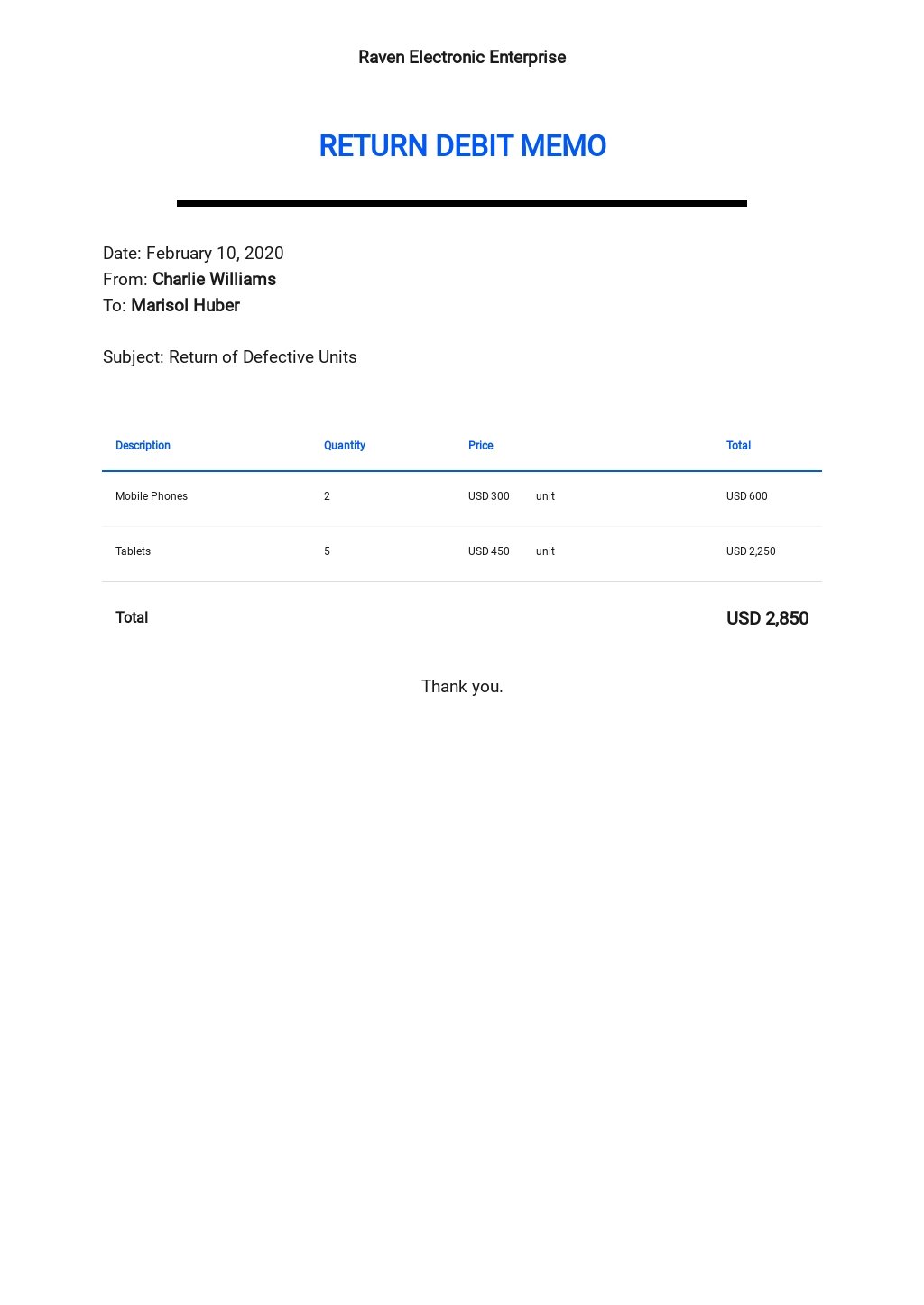

A credit note may also be used when a buyer is purchasing services rather than goods if the service does not meet customer expectations.Ī memo is typically thought of as a written document, in a letter format, used for business communications. Other reasons that a buyer’s account may need to be credited include incomplete orders, accidentally sending an invoice to a buyer, or customer dissatisfaction with the items received. If a buyer receives damaged or deficient goods, a credit may be issued for future purchases and to document the return of the goods. There are several reasons that a seller might issue a credit note. For returned items, the buyer updates their purchase return account, whereas the seller updates their sales return account to show the decrease in revenue.

#Debit memo update

The buyer can then use that credit memo to update their accounting books to reflect the reduction in liability to pay the seller and a decrease in expenses. For example, a vendor would issue a credit note to a customer to document the reason for and amount of credit. However, credit notes are typically commercial documents used between businesses. The note functions similarly to a consumer receiving store credit for returning a retail purchase, which they can then use to purchase other items at the store.

#Debit memo professional

Professional Services Get expert help to deliver end-to-end business solutions.Technical Support Get expert coaching, deep technical support and guidance.Help Center Get answers to common questions or open up a support case.Smartsheet University Access eLearning, Instructor-led training, and certification.Community Find answers, learn best practices, or ask a question.Learning Center Find tutorials, help articles & webinars.What’s up next New data insights and faster, easier ways to find and organize your work.WorkApps Package your entire business program or project into a WorkApp in minutes.

0 kommentar(er)

0 kommentar(er)